For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Individual Income Tax In Malaysia For Expatriates

Our online advance income tax calculator is mobile friendly and can be used in both computers and mobile devices in a hassle free fashion.

. Also check the sales tax rates in different states of the US. An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961The best part about this deduction is one can avail it even after availing the maximum provided deduction of Rs1 50 000 under Section 80C. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

7 areas in Klang Valley affordable for middle-income earners. The Income Tax Department will pay an interest at 6 per cent per year on the excess amount only if your amount is more than the 10 per cent of your tax liability. Tax Benefits under Section 80E.

For more information about or to do calculations involving income tax please visit the Income Tax Calculator. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Value-Added Tax VAT.

The calculator is designed to be used online with mobile desktop and tablet devices. SEE WHAT OTHERS ARE READING. Simply click on the year and enter your taxable income.

Guide To Using LHDN e-Filing To File Your Income Tax. Setting the Calculator up for Income use the following variables. Review the full instructions for using the Malaysia Salary After Tax Calculators which details.

Even though the progressive rates for personal income tax rates range from zero to 22 percent in Singapore the effective payable tax may come out to be much lower if one takes advantage of the various schemes the Singapore Government has initiated. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. Income Tax Reliefs for Tax Residents in Singapore either local or foreign tax-resident.

As of 2019 the average income in Malaysia is RM7901. How Does Monthly Tax Deduction Work In Malaysia. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2021. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. The calculator treats the investment gain ROI as realized and the taxes get deducted on the first cash flow date after the first of each year.

Free calculator to find the sales tax amountrate before tax price and after-tax price. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

What is B40 M40 and T20. B40 M40 and T20 Malaysia refer to the household. Generally if an investment is not tax-free then you would owe taxes on the realized gains.

What is the average income in Malaysia. Tax Offences And Penalties In Malaysia. Greece India Canada Singapore and Malaysia.

How To Pay Your Income Tax In Malaysia. How to start where to check the latest price of gold.

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

Cukai Pendapatan How To File Income Tax In Malaysia

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

7 Tips To File Malaysian Income Tax For Beginners

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Malaysian Tax Issues For Expats Activpayroll

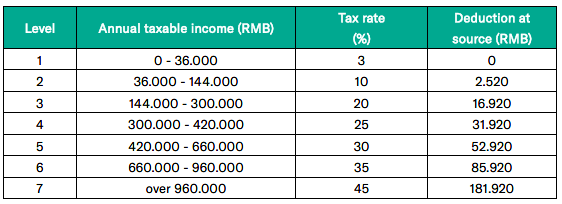

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax On Salary Flash Sales 50 Off Www Ingeniovirtual Com

10 Things To Know For Filing Income Tax In 2019 Mypf My